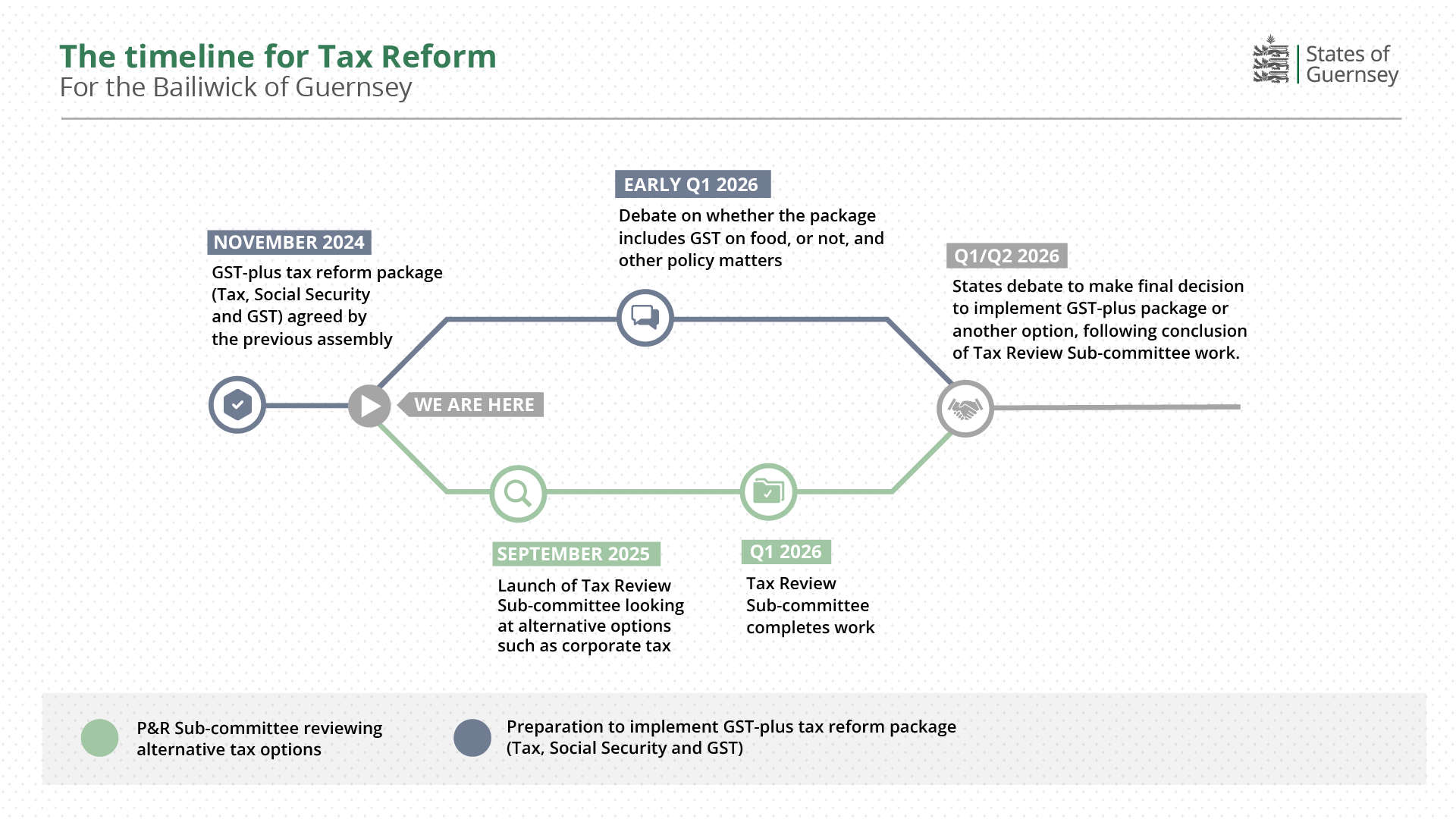

Policy and Resources has published a timeline to reach a final State's decision on tax.

Over the next few months, two programmes of work will be explored simultaneously to help the States make a final decision on tax reform.

One workstream will explore how the ‘GST-plus’ tax package, which the previous States agreed in November 2024, can be implemented.

Meanwhile, the newly formed Tax Review Sub-committee will explore alternative options, such as corporate tax

In early 2026, the States will debate whether to include GST on food or not.

The Tax Review Sub-committee will then present its findings to Policy & Resources, and the Committee will then publish a policy letter with its recommendations.

P&R Member Deputy Charles Parkinson will lead the Tax Review Sub-Committee.

"I have been consistent for some considerable time in my view that corporate tax reform has the potential to play a significant role in addressing our fiscal difficulties.

"That is, of course, a personal view but one that I expressed throughout the election campaign, so I am pleased my colleagues on P&R have asked me to lead the work of the Tax Review Sub-Committee to review alternative options such as corporate tax.

"While there continues to be healthy discussion and debate around the right solution, what should be beyond discussion at this stage is that there is an urgent need for tax reform to safeguard public finances in the years ahead.

"This cannot be an issue that continues to be kicked down the road and that is a key test for this new

States.

"We want to make sure the Assembly has all the necessary information to allow them to make an informed final decision before the end of Quarter 2 next year.

"My intention is that the work of the Tax Review Sub-Committee will be as open as possible.

"That starts today with the publication of the terms of reference for the work we’ll be doing over the next few months, but will extend to regular updates and involve independent and impartial experts.

"The community must be engaged in this work so that they can be reassured both about the process and that no stone has been left unturned."

Deputy Parkinson will be joined in the Tax Review Sub-committee by Deputy Gavin St Pier, and three international tax policy experts: Mr Bill Dodwell, Professor Peter Harris, and Mr Mike Williams.

Guernsey's Water Lanes to remain uncovered

Guernsey's Water Lanes to remain uncovered

Guernsey's greenhouse gas emissions fall

Guernsey's greenhouse gas emissions fall

Work on Guernsey's Victor Hugo Centre may begin by Easter '27

Work on Guernsey's Victor Hugo Centre may begin by Easter '27

Channel Islands mobile portability issues to be resolved soon

Channel Islands mobile portability issues to be resolved soon

Channel Islanders in the Middle East told to follow local warnings

Channel Islanders in the Middle East told to follow local warnings

Freehold of Guernsey's Premier Inn for sale

Freehold of Guernsey's Premier Inn for sale

Unprecedented demand for cesspit emptying in Guernsey

Unprecedented demand for cesspit emptying in Guernsey

Food will not be exempt from GST in Guernsey

Food will not be exempt from GST in Guernsey