Jersey businesses working from government-owned properties could be offered a full or partial rent waiver if they can prove they've been severely affected by Covid-19 trading restrictions.

The government says all its business tenants have been offered a rent deferral during the pandemic and that under a new 'Government as Landlord Policy', the likes of rent holidays and early lease terminations will also be considered.

"Deferring rent is not always the best long-term solution; for businesses which still have virtually no income, it merely compounds their debt.

"Government’s new policy enables us to provide support which is based on a tenant’s individual circumstances. The deferred rent will remain repayable for the time being but, for tenants who demonstrate that they’re being severely affected by COVID-19 trading restrictions, may be offered a partial or even complete rent waiver, and a revised tenancy agreement.

"We want to help Jersey businesses to continue to trade, and charging less rent is preferable to losing a tenant and a Jersey company." - Deputy Kevin Lewis, Infrastructure Minister.

Jersey Business will support any tenant to gather the necessary information needed to put their case forward. Guidance is available here.

"I would urge the private sector to follow Government and adopt the framework.

"Jersey Business will provide free and confidential advice to businesses that need to renegotiate their rents or would like to review their financial position and cash flow.

"Tenants and landlords should consider their current and forecast cash flows, and act reasonably and transparently. Tenants should think about what they can offer their landlords, while being aware that their landlords are also likely to have their own financial commitments." - Deputy Lewis.

Meanwhile, all Jersey businesses are being urged to review their finances as we move into the winter months.

Assistant Treasury Minister Senator Ian Gorst says carrying out a regular 'health check' will help to manage costs, maximinise income and find changes that'll give businesses the cash needed to stay afloat.

"The COVID-19 pandemic has caused disruption and difficulties for our entire Island. We are conscious that the situation has had a particularly significant impact on many local businesses.

"Now we are in Level 1 of the Safe Exit Framework, we would like to encourage all businesses to review their financial position and cash-flow, particularly as we approach the end of the year and the autumn and winter months.

"We acknowledge that many businesses will have already undertaken, and be undertaking, such reviews and encourage all businesses to do so.

"If required, help is available through Jersey Business and Citizens Advice, who can assist and support a financial review."

Nude Dunes planning application refused again

Nude Dunes planning application refused again

128 homes to be built in St Peter

128 homes to be built in St Peter

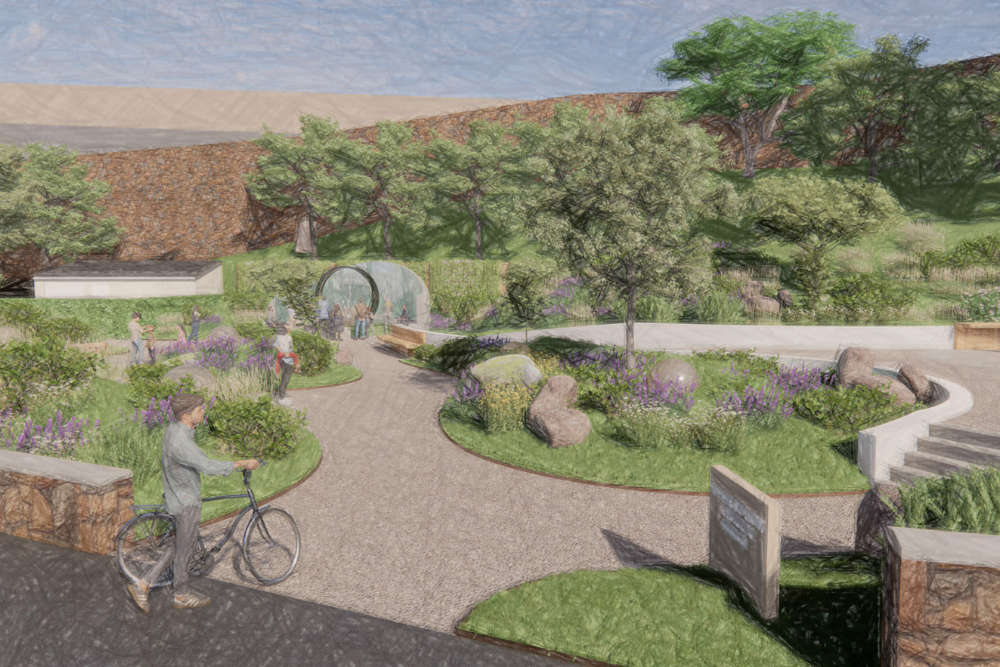

Haut du Mont memorial garden to include victims' favourite flowers and play area

Haut du Mont memorial garden to include victims' favourite flowers and play area

Woman sexually assaulted at First Tower

Woman sexually assaulted at First Tower

Single-use vapes banned from next month

Single-use vapes banned from next month

Guernsey Post launches world first 'Cyberstamps' rather than 'Cryptostamps'

Guernsey Post launches world first 'Cyberstamps' rather than 'Cryptostamps'

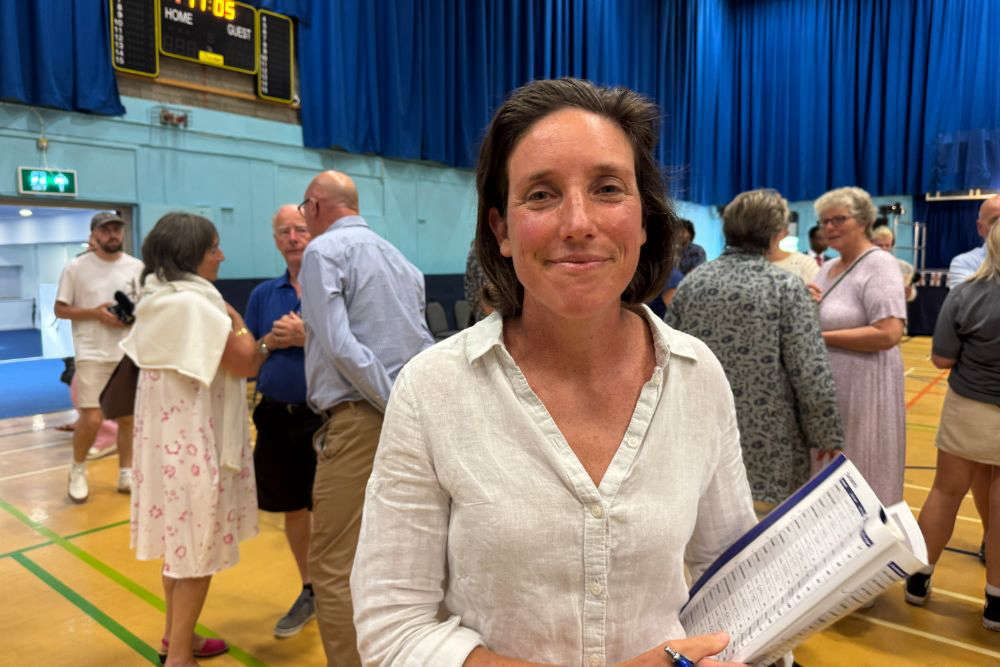

Guernsey gets first woman Chief Minister

Guernsey gets first woman Chief Minister

Cost of more health appointments reduced by £10

Cost of more health appointments reduced by £10