An attempt to reduce the government's level of borrowing by £345 million over the next four years has been rejected.

The government plan proposes the debt hitting £1.7billion by 2025 to spend on the new hospital project, Covid costs, and refinancing pension debt.

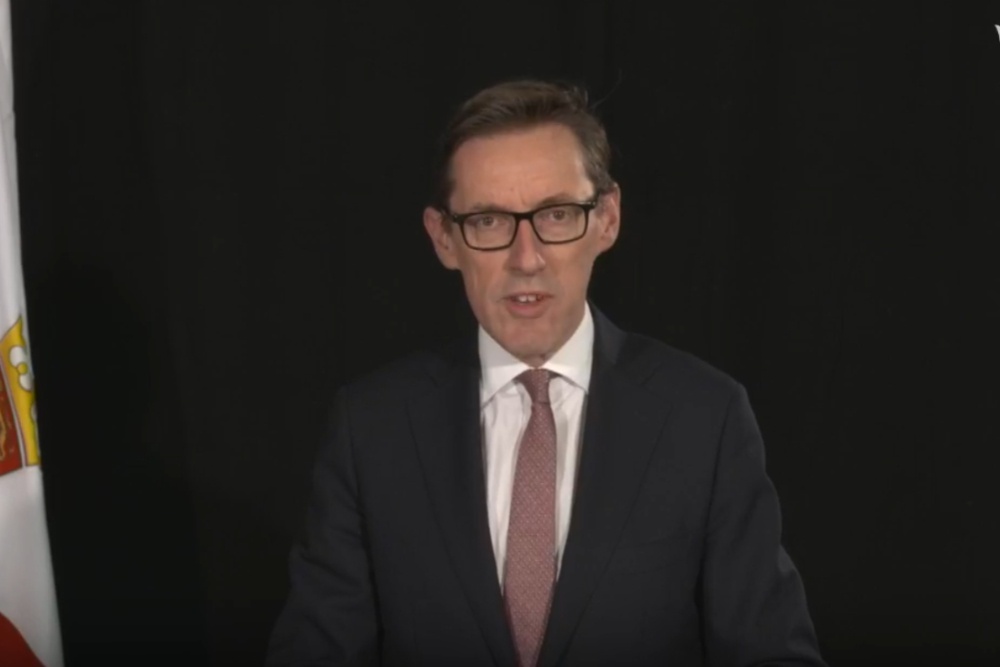

Senator Ian Gorst argued that it could see generations of islanders saddled with a legacy of debt, when more sensible options were available.

"I contend that it's the wrong time. I also contend that we don't actually, in the proposal before us in the Government Plan, have sufficient detail.

I talked about this during the hospital borrowing debate. For me, to move in one parliamentary cycle from those low levels of borrowing to extremely high levels of borrowing is a risk, it's a risk that's not been quantified, and I think it's a risk that we don't actually need to take.

It was, and is the right thing to do, to pay for the hospital. But we should not add on top of that momentous decision, the risk that the government is asking us to add.

Our own independent economic advisers tell us that while they are broadly supportive of this plan, the next government, if this plan is maintained as it is, will have to raise taxes.

Surely it is right to pause, it is right to review, and ask ourselves is this the right decision today? Or should we give ourselves a few more months to properly quantify the risks, properly understand the economic conditions, and properly understand the other options?"

In response, the Treasury Minister said the refinancing of pension liabilities is long overdue and could get worse if it's not dealt with quickly.

On concerns about burdening future generations of islanders with debt, Deputy Susie Pinel said the government's plan is fully funded and does not impact government services or require tax increases.

"Whilst the borrowing will be in place for a period of probably 30 to 35 years, it will be repaid at roughly the same time as the current PECRS (Public Employees Contributory Retirement Scheme) liability, but at a far lower cost.

The current interest rate environment is conducive to entering into longer-term borrowing at a fixed cost, there is a strong investor appetite for the States of Jersey to issue bonds, the total level of borrowing proposed at £1.7billion still only represents approximately 36% of GVA (Gross Value Added).

This is a position that would be the envy of many developed economies.

Our key reserves will remain intact to protect the island against any future shocks, whether they be economic, environmental, or social."

Senator Gorst's amendment was rejected by 26 votes to 21.

Many politicians said it was 'sensible' and 'the right time to borrow, with Senator Gorst's proposal also called 'imprudent' by Senator Sam Mézec.

The Chief Minister, Senator John Le Fondre, said future members of the States may well wonder why this assembly 'missed the opportunity to grasp that nettle and lock in those savings when it had a very clear opportunity to do so.'

"I would invite members to think about students in that school (Les Quennevais) and their peers and in 30 years time, new assembly members could be some of those students, they may well sit right here in this Chamber and look back at the decisions of previous assemblies and will they see that we decisively seized what is a historic opportunity, leaving them a windfall of millions of pounds.

Or will they observe that we dithered and deferred this decision, missing our chance to utilise the low interest rates before us, and leaving them to then have to work out how to pay off our debt?"

Politicians did agree to one section of Senator Gorst's proposal, which was to pay back the borrowing related to Covid-19 and the Fiscal Stimulus Fund by the end of 2026.

Nude Dunes planning application refused again

Nude Dunes planning application refused again

128 homes to be built in St Peter

128 homes to be built in St Peter

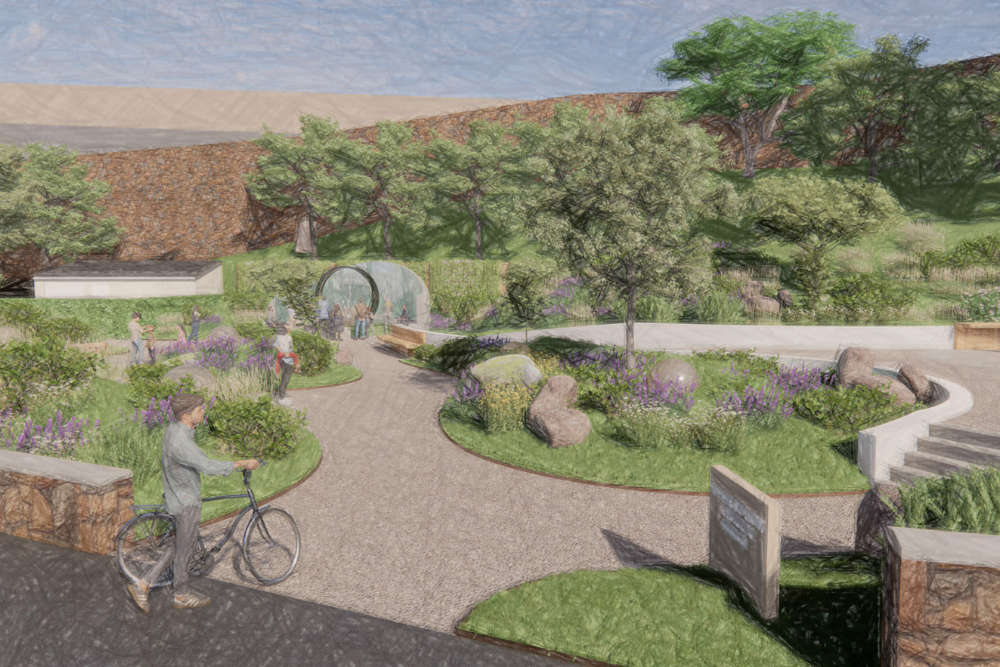

Haut du Mont memorial garden to include victims' favourite flowers and play area

Haut du Mont memorial garden to include victims' favourite flowers and play area

Woman sexually assaulted at First Tower

Woman sexually assaulted at First Tower

Single-use vapes banned from next month

Single-use vapes banned from next month

Guernsey Post launches world first 'Cyberstamps' rather than 'Cryptostamps'

Guernsey Post launches world first 'Cyberstamps' rather than 'Cryptostamps'

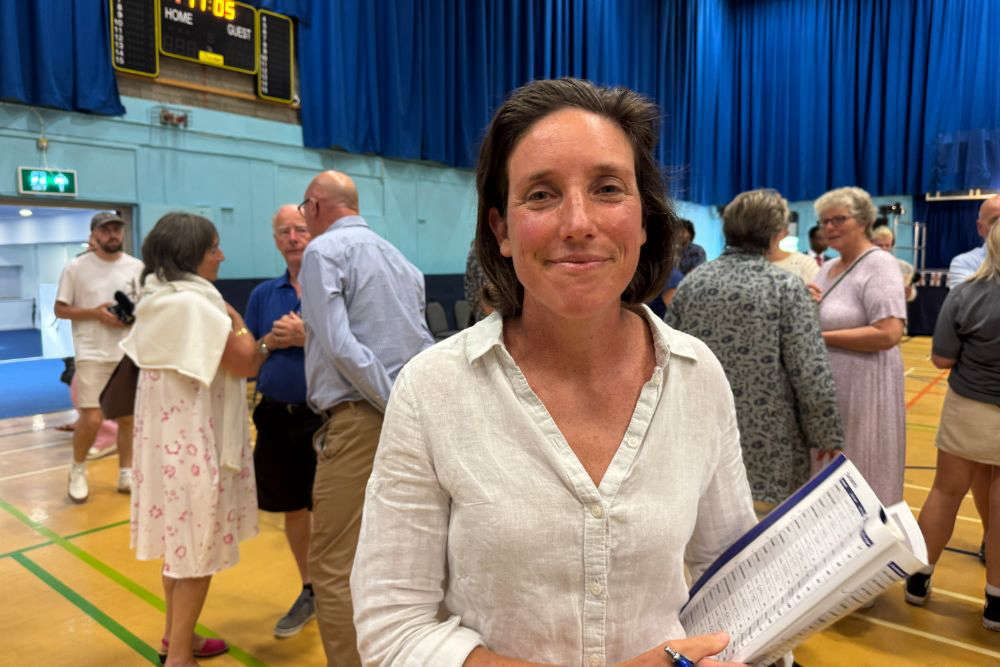

Guernsey gets first woman Chief Minister

Guernsey gets first woman Chief Minister

Cost of more health appointments reduced by £10

Cost of more health appointments reduced by £10