44 overseas retailers are now collecting GST on behalf of Jersey's government at the point of sale.

Since last summer, retailers including Amazon and others have been adding the 5% tax at the checkout.

Neither the government, nor Amazon UK, would disclose the amount of tax revenue that has generated.

But figures obtained by Channel 103 in a Freedom of Information request have revealed that the total amount of GST collected in the last six months of 2023 was £2 million less than in the same period last year.

It was down from £59.3 million to £57.3 million.

That is despite more of our online purchases being subject to the tax.

Carl Walker from Jersey Consumer Council says the figures point to the impact of high inflation:

"What these figures, obtained by Channel 103, show us is that for the time time we have got some statistics behind the cost of living crisis.

We can clearly see that islanders spent, in the last six months of last year, £40 million less than they did in the last six months of the year before that, so it really does give us an indication of how islanders have been tightening their belts."

Another change introduced last July was a lower threshold (de minimus) of £60, meaning items imported from smaller retailers worth more than £60 are held by Customs until the GST is paid.

The amount collected via the online Customs declarations, not including those made by businesses, was £1.7m from July to December 2023.

That figure is largely unchanged from the year before, although there were around 12,000 more declarations.

44 overseas retailers are now collecting GST on behalf of Jersey's government at the point of sale.

Carl Walker says the changes have undoubtedly made online shopping more expensive, but it is hard to judge if they have done anything to encourage us to choose the high street instead:

"We can now see that there are more than 40 online retailers based overseas collecting GST on behalf of the Jersey Government. In reality, the online shopping tax threshold has effectively been scrapped for all of us. It means we are paying GST on everything we buy now, whether locally or online.

The government always billed this move to lower the de minimus level, or tax threshold, as a way of 'levelling the playing field'. It is very difficult to see whether this move is having the effect that the government wanted it to."

£4.5M goes to Jersey charities from dormant bank accounts

£4.5M goes to Jersey charities from dormant bank accounts

Five JT mobile phone sites vandalised

Five JT mobile phone sites vandalised

Queen's Valley reservoir reopens

Queen's Valley reservoir reopens

Nude Dunes planning application refused again

Nude Dunes planning application refused again

128 homes to be built in St Peter

128 homes to be built in St Peter

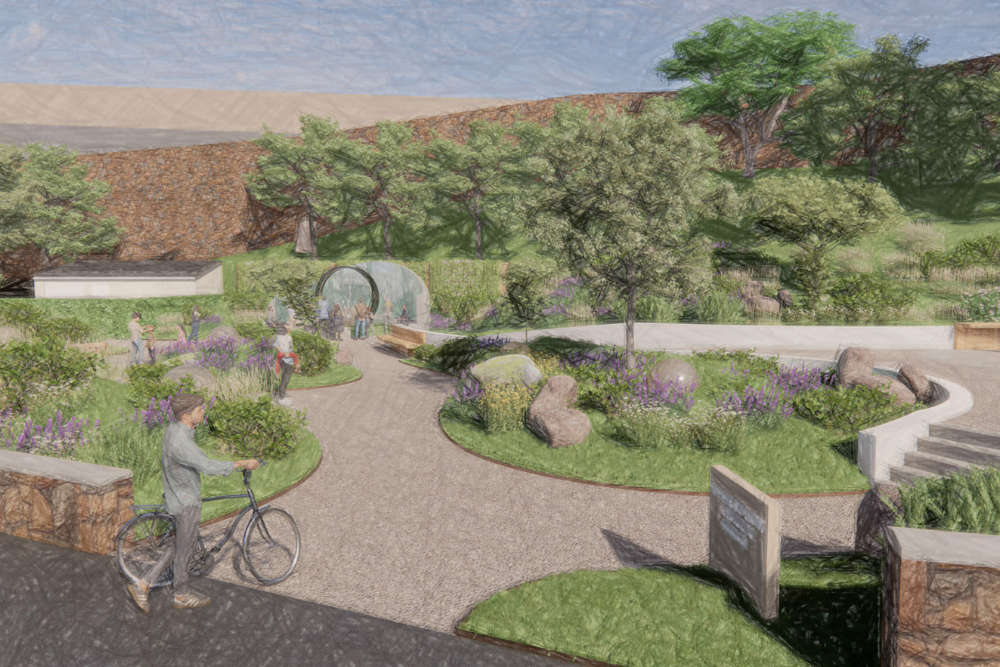

Haut du Mont memorial garden to include victims' favourite flowers and play area

Haut du Mont memorial garden to include victims' favourite flowers and play area

Woman sexually assaulted at First Tower

Woman sexually assaulted at First Tower

Single-use vapes banned from next month

Single-use vapes banned from next month