Plans to make independent taxation mandatory have been presented to the States, which would see couples submitting their own paperwork from 2026.

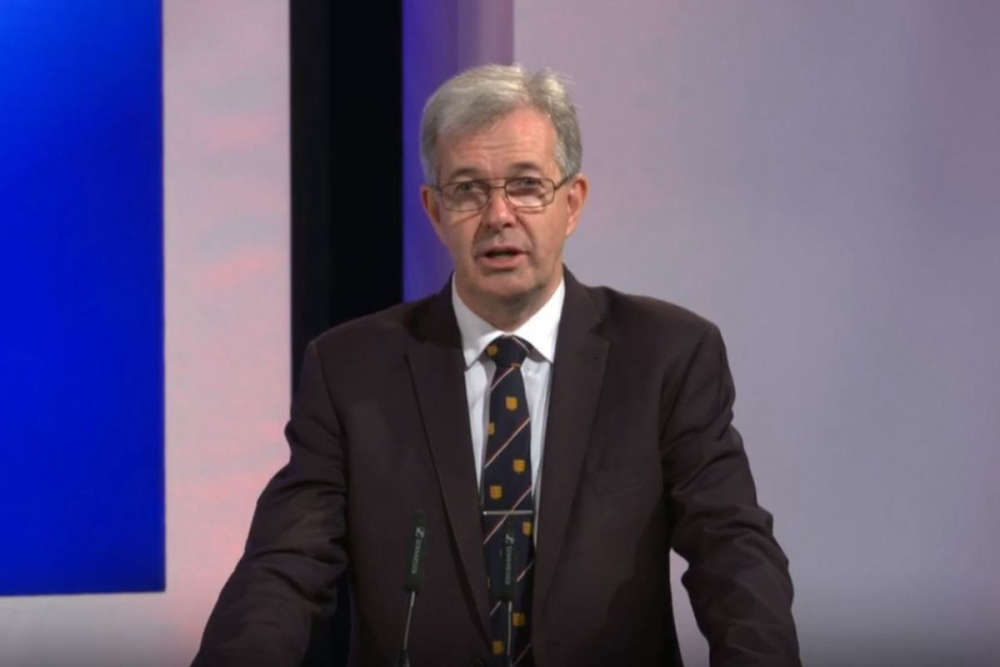

But, Lyndon Farnham has sent in his own proposition to make the move optional

"I think the new legislation is unnecessary, so far as part of the 19,000 tax-paying couples we only have 121 in a pilot group and 282 others have opted for independent taxation.

The system of joint taxation has worked extremely well and is convenient, especially for our older generation."

Deputy Elaine Millar, who has brought forward the draft law in her capacity as Assistant Treasury Minister, says in her report that running parallel systems would cost the Treasury upwards of £500,000.

Deputy Farnham disputes that, saying the report also says that the move would raise £5.5m for the department.

"Whilst Revenue Jersey claim that they will incur additional costs I can't see anywhere that is proven.

They also haven't incorporated the costs of processing the additional 19,000 returns that will come in."

Deputy Millar says acknowledges in the proposals that independent taxation would mean that nearly 7,000 people would be worse off because of higher tax liabilities.

To offset that, a 'compensatory allowance' will come into effect for 10 years.

But Lyndon Farnham says its not clear how that will work.

"Islanders that have contacted me say that they don't have the confidence that the compensation is going to be appropriate, accurate or paid in a timely fashion."

Both propositions will be debated in the States in July.

'Momentous' week in Jersey's States

'Momentous' week in Jersey's States

Plans to charge wealthiest patients for medical travel

Plans to charge wealthiest patients for medical travel

Railway Walk reopens 'several weeks' ahead of schedule

Railway Walk reopens 'several weeks' ahead of schedule

New bar opening at former Rojo and X site to evolve Jersey's nightlife

New bar opening at former Rojo and X site to evolve Jersey's nightlife

Former Chief Minister seeks re-election

Former Chief Minister seeks re-election

Château Vermont to become home to new music campus

Château Vermont to become home to new music campus

St Saviour break and entry suspect pictured posing on motorbike

St Saviour break and entry suspect pictured posing on motorbike

'Overstretched' neurology department following under-experienced managers

'Overstretched' neurology department following under-experienced managers