Jersey's government has been told it didn't do enough to make sure every business claiming Covid-19 wage subsidies knew the rules.

The States of Jersey Complaints Board has upheld a grievance from a sole trader about the Co-funded Payroll Scheme.

It provided up to 90% of total income to a maximum of £2,500.

Self-employed businesswoman Natalie Mayer accessed the funding for a six month period.

The board heard she had 'taken all possible steps' to seek clarity over the meaning of 'monthly gross income' for a sole trader.

Last January she was told she had incorrectly claimed in relation to turnover. She blamed the lack of clear information.

Panel Chair Geoffrey Crill says the government's use of the terms 'turnover' and 'gross income' was confusing and led to over-payments, which the Treasury has been trying to recoup.

He added that threats of legal action have been made against Ms Mayer, and a number of other people, who made claims 'in good faith'.

“The COVID-19 pandemic was an unprecedented event and the introduction of the CFPS was a bold and brave initiative by Government, which provided invaluable and speedy support to many Islanders and small businesses.

The Treasury and Exchequer made it clear that applications would be checked retrospectively and where any overpayment was found to have been made, would seek to recover the amount.

However, the key element of this case was communication. There was an assumption that people were able to understand what they could claim for by reading the Guidance Notes and the FAQs, but this case has shown that the difference between the eligibility criteria and the amount that could be claimed from the CFPS was not clear to some applicants.”

He added:

"The Department did not take adequate steps to ensure that the distinction was understood by all applicants and the helpline simply referred applicants back to the guidance. The threat of legal proceedings should have only been introduced as a last resort if the people involved failed to engage with the Department.”

The Treasury has been told to accept responsibility and reduce the amount owed by Ms Mayer.

Assistant Chief Minister Constable Andy Jehan says they need to balance the interests of the complainant with the 92% of business owners who did understand the rules.

"This government introduced a repayment appeal process because we recognised many people with repayment requirements had mistakenly claimed more than they were entitled to.

...With the benefit of hindsight, there is always more that could be done to ensure that all claimants had a complete understanding of the scheme's rules

...Reflecting on the panel’s suggestion that ex gratia reductions should be made to the amount owed by the complainant in this case, we are acutely conscious of the need to balance the interests of those like the complainant and the interests of other business owners – some of whom may be direct competitors – who understood the rules and claimed as the scheme intended.

We will take the necessary time to carefully consider the findings of the report to ensure that similar schemes are implemented even more effectively going forward.”

£4.5M goes to Jersey charities from dormant bank accounts

£4.5M goes to Jersey charities from dormant bank accounts

Five JT mobile phone sites vandalised

Five JT mobile phone sites vandalised

Queen's Valley reservoir reopens

Queen's Valley reservoir reopens

Nude Dunes planning application refused again

Nude Dunes planning application refused again

128 homes to be built in St Peter

128 homes to be built in St Peter

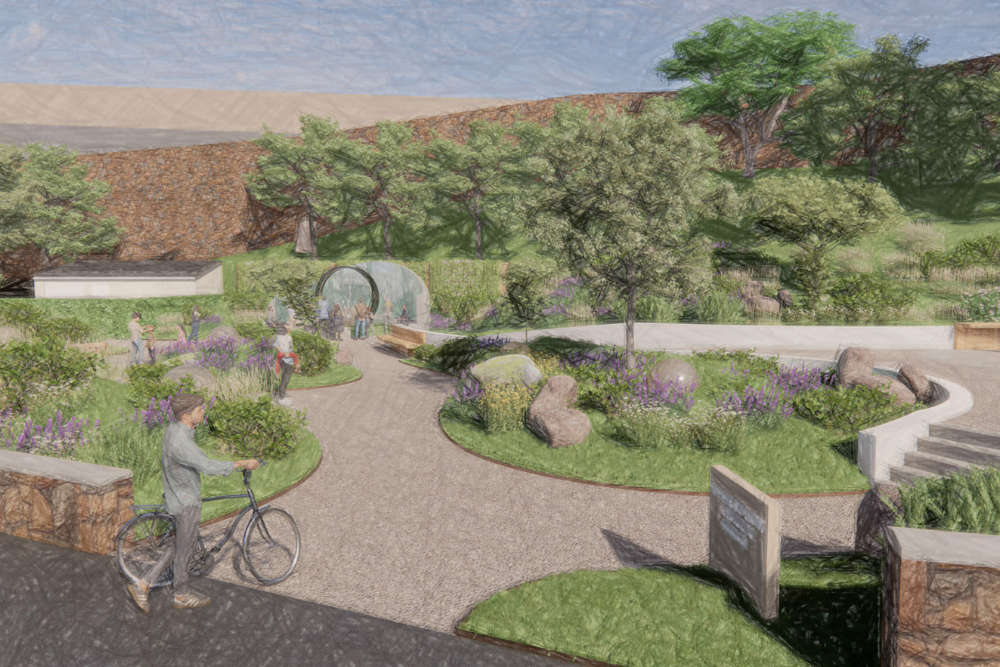

Haut du Mont memorial garden to include victims' favourite flowers and play area

Haut du Mont memorial garden to include victims' favourite flowers and play area

Woman sexually assaulted at First Tower

Woman sexually assaulted at First Tower

Single-use vapes banned from next month

Single-use vapes banned from next month